Manage Your Income with Wisdom

At least one must work, you or your money.

Have you ever dabbled in investing?

If the answer is "no," you probably want to start investment journey soon.

Because... it's highly like you will earn a lot shortly after in your life!

Based on latest data updated on Jan 12, 2024, in the past 3 years, 84% of CMU graduate students got a job with a median salary of $129,000[1].

If we reference the average household income in United States in the past 10 years, $72,083[2], a single CMU graduate earns 79% more than a whole family do.

There is no doubt that $129,000 is a six figure.

However, be careful. It is not only a treasure but also a double-edged sword.

Before getting too excited, calm down and think about it.

What do you really want? Do you have a long-term plan yet?

I have seen people got lost quickly by these big numbers and end up having nothing.

Let's See a Real Example

A well-paid software engineer from Seattle only got $20,000 in his bank account after working 3 years.

What happened?

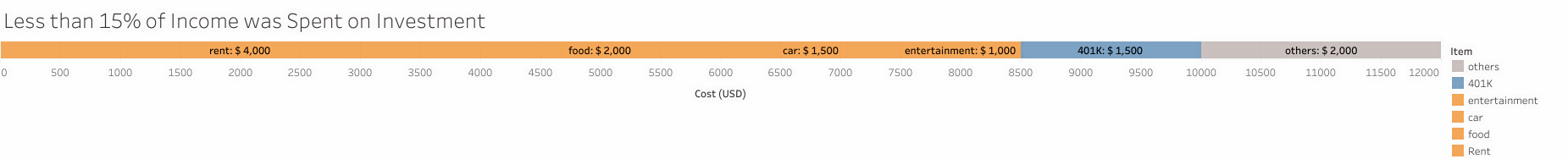

The target was a software developer living in Seattle, Washinton. He got an offer of $179,000 salary, about $12,000 per month after tax.

The following is a table of his cost structure per month.

|

Item |

Cost |

Explanation |

|---|---|---|

|

rent |

$4000 |

base rent ($3200) + parking ($350) + Internet + water + electricity |

|

car |

$1500 |

loan ($1050) + gas + maintenance |

|

food |

$2000 |

weekly fine dining |

|

entertainment |

$1000 |

games + ski + equipment |

|

401K |

$1500 |

money you invest for your retirement |

|

others |

$2000 |

remaining in checking account |

This cost structure is extremely vulnerable to changes. Without a safe minimum deposit in bank account, it becomes challenging to survive some crisis. For example, the COVID-19.

Before the pandemic hit, the employment rate was 71.8% on Jan 2020[5].

After the pandemic hit US, it quickly dropped to 60.19% in 4 months (Apr 2020.)

The whole nation took 3 years to recover.

Fight Inflation

One might say, "Oh, why don't I just save most of money instead?"

Unfortunately, another enemy called inflation will teach you another lesson.

The average housing price in United States has increased by 31.45% since 2020[4].

In fact, my favorite Boba tea was $5.2 three years ago, but now it is being sold for $7.5 (44.2% price increase.)

Your assets do not hold their values if you just put them in your checking account.

Start Investment Now

Identify what type of investor you are and pick the appropriate investment type for yourself.

Investment Options

Disclaimer: This is not a financial advice. Risk and payback below are based on my real investment experiences in the past 5 years.

Photo by Josh Appel on Unsplash

Photo by Josh Appel on Unsplash

Savings

Properties

Low Payback (+2-3%)

Low Risk (A good start)

What Could You EARN or LOSE Annually?

(Assuming investing $100,000)

One month rent for a 2B apartment in Pittsburgh.

Photo by Adam Nowakowski on Unsplash

Photo by Adam Nowakowski on Unsplash

Mutual Funds

Properties

Medium Payback (+/-5% -15%)

Medium Risk (Try with caution later)

What Could You EARN or LOSE Annually?

(Assuming investing $100,000)

Six-month rent for a 2B apartment in Pittsburgh.

Photo by Maxim Hopman on Unsplash

Photo by Maxim Hopman on Unsplash

Stocks & Digital Currencies

Properties

High Payback (+/-30% - 50%)

High Risk (Don't touch it now)

What Could You EARN or LOSE Annually?

(Assuming investing $100,000)

Your tuition to study at CMU.

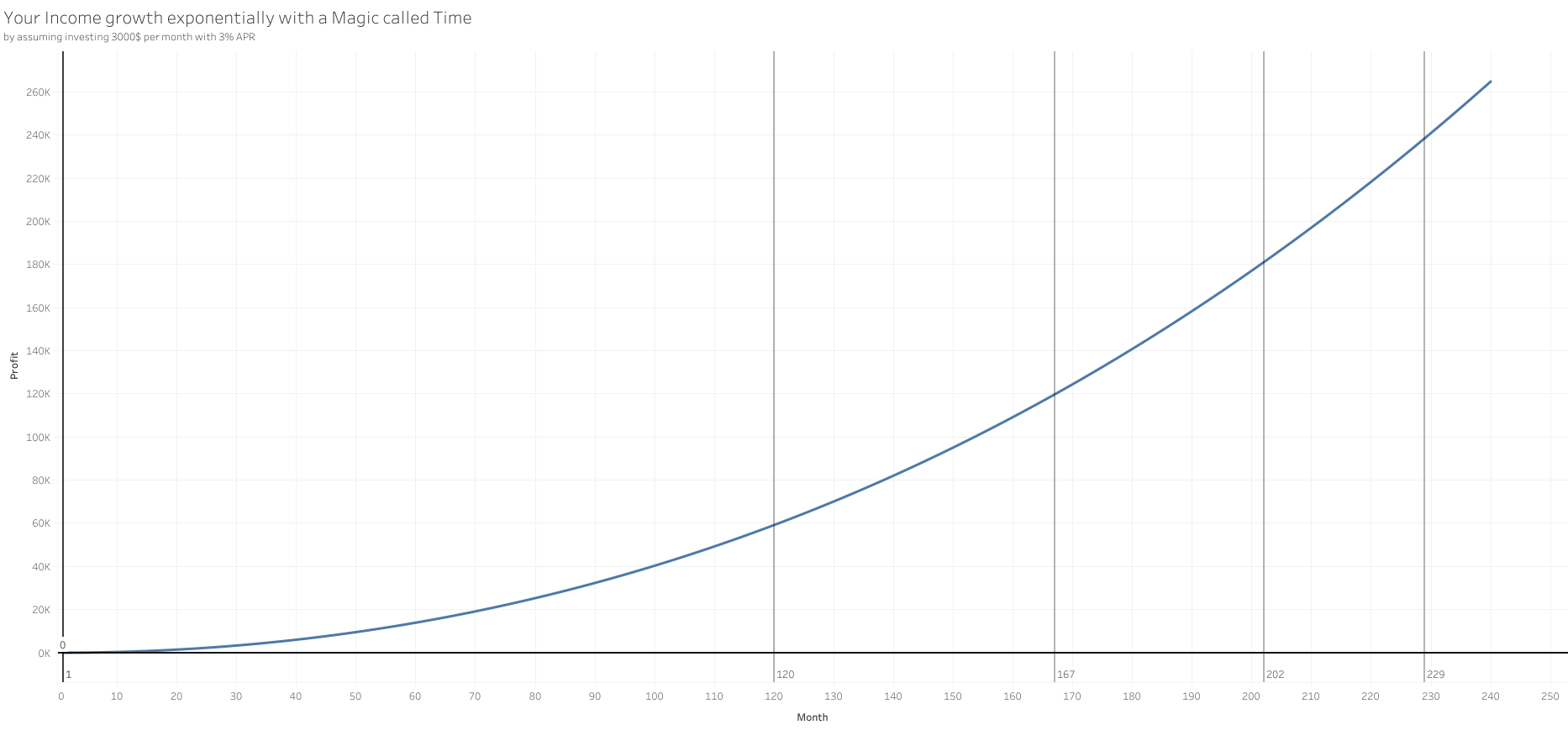

Some people might be concerned about not having enough knowledge or experience in investment before. Don't worry, you can rely on your best and reliable friend: time.

Your assets grow slowly at the beginning, but as time goes, they grow faster, and eventually launch like a rocket.

Suppose you invest $3000 per month with an APR (Annual Percentage Rate) of 3% (not a high number,) it takes 120 months to earn $60,000, but it only takes another 47 months to earn another $60,000. After your put your money in deposit for 200 months, you just need 27 months to earn the same number.

Don't be afraid. It is not hard to start.

You can explore some basic concepts on Investopedia and try to talk to an agent in the bank you like.

After your embarkation, your life is about to change.

References

[1] Carnegie Mellon University. “First Destination (Post Graduation) Outcomes - Career & Professional Development Center - Student Affairs - Carnegie Mellon University,” n.d. https://www.cmu.edu/career/outcomes/post-grad-dashboard.html.

[2] U.S. Census Bureau, Real Median Household Income in the United States [MEHOINUSA672N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEHOINUSA672N, February 21, 2024.

[3] Organization for Economic Co-operation and Development, Employment Rate: Aged 15-64: All Persons for United States [LREM64TTUSM156S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LREM64TTUSM156S, February 20, 2024

[4] U.S. Census Bureau and U.S. Department of Housing and Urban Development, Average Sales Price of Houses Sold for the United States [ASPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ASPUS, February 26, 2024.

[5] Organization for Economic Co-operation and Development, Employment Rate: Aged 15-64: All Persons for United States [LREM64TTUSM156S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LREM64TTUSM156S, February 28, 2024.