Inflation

The Hidden Tax

BACKGROUND

The Federal Reserve took drastic measures in 2020 to save the economy from the ongoing COVID crisis. The solution was to print large sums of money and inject it into the market, people were hearing about them in the news and curiosity was peaking. They might have seemed like heroes at the time because it did stimulate the economy and looked like the bounce-back was even stronger than the downfall. But the negative impacts of these actions were beginning to show much later, the people were now curious about something else - Inflation.

This story aims to educate readers about the various aspects of it such as - What is inflation? What causes it? How does it matter to the average citizen? Can they be better prepared?

Let's find out -

What is Inflation?

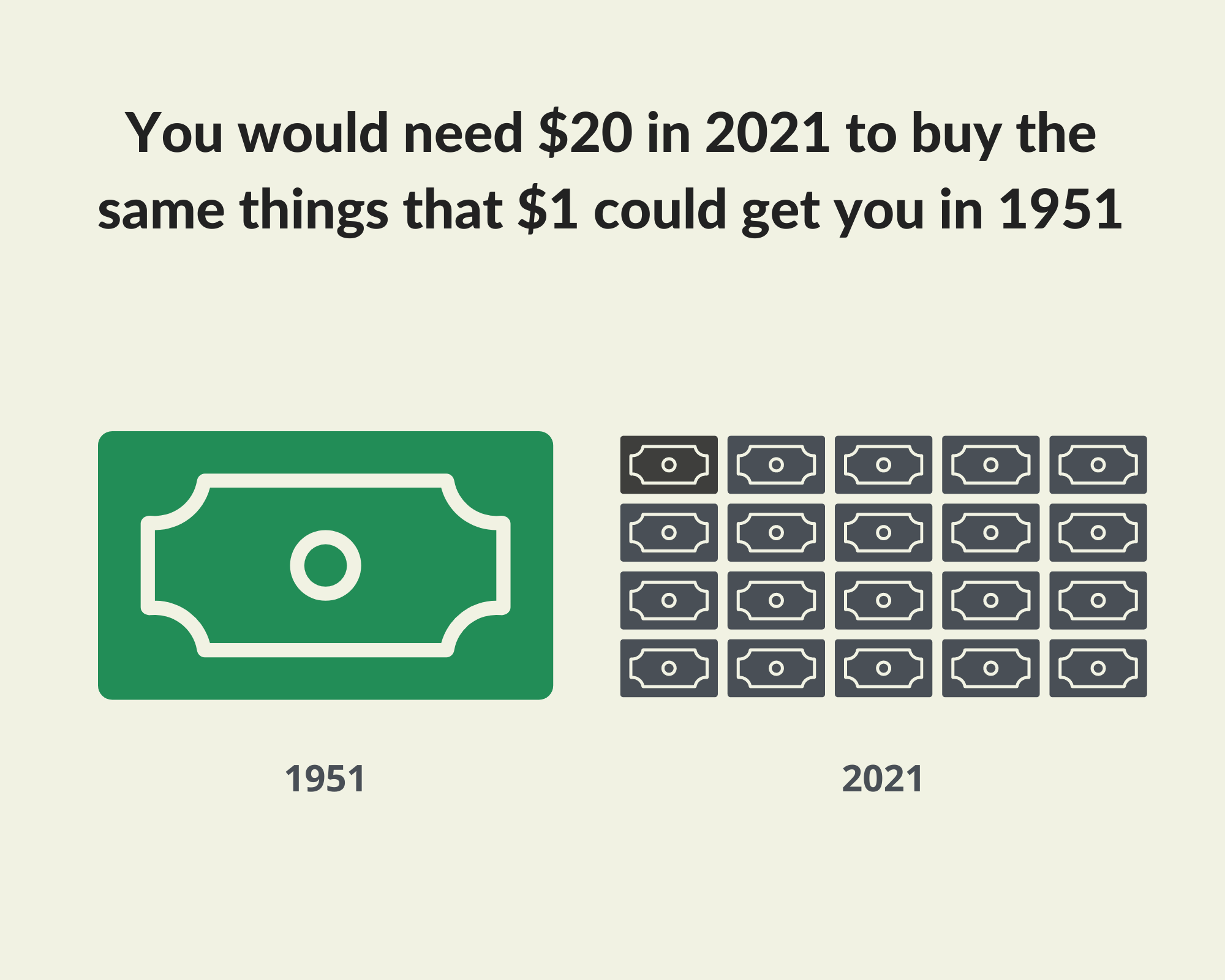

A chocolate bar used to cost 10 cents in 1960 and now costs $1, which means that $1 used to buy ten bars but now only buys one. This is the basic concept of inflation, specifically -

"It is a general rise in the price level of an economy over a period of time."

When you hear your grandparents recall, "A movie and a bag of popcorn only cost a buck-twenty-five when I was your age," they are making an observation about inflation—the rising cost of goods and services over time, and the decrease in the purchasing power of the dollar. (Kent Thune, 2021)

The problem isn’t limited to chocolates, popcorn, or movie tickets but most goods and services that are part of your daily life. Loans, insurance, and real estate, all are affected by Inflation but not in a positive manner.

You might now wonder – Why does Inflation happen and what causes it?

What Causes Inflation?

Inflation is a natural phenomenon in economies and if it occurs at a small steady scale, it is not very detrimental. The problems occur when it happens due to these

When the prices of raw materials increase or there's a rapid wage increase it causes the input costs of products to increase. Hence, we as consumers have to pay more to compensate for that increase. This effect is mostly natural and can still be born.

The second and major problem that we will be discussing in this story is - the 'Federal Monetary Policy

Supply of Money

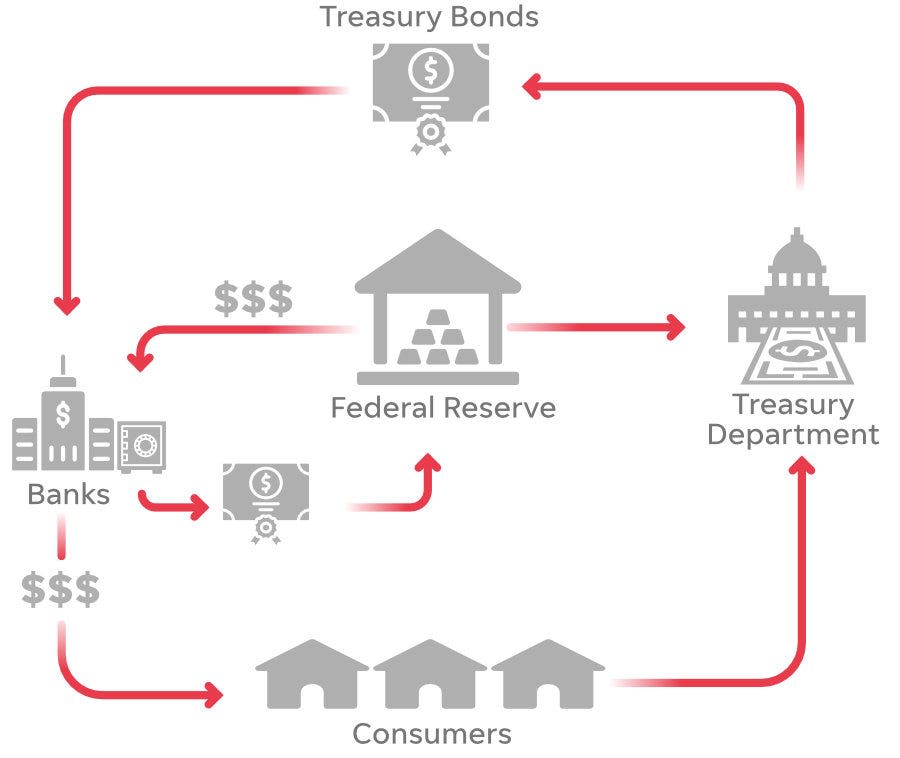

As the economic output of a country increases, there is a need for more money in circulation to support the transactions. This incremental supply is supposed to go hand in hand with the growth of an economy. Things get problematic when Inflation is caused by the government's money printing habits.

Governments need money to function, and hence they collect taxes. Mostly, the taxes aren't enough because they always plan to spend more than they can gain from taxations. Also, taxes are unpopular, who'd risk that in case of a re-election campaign coming up?

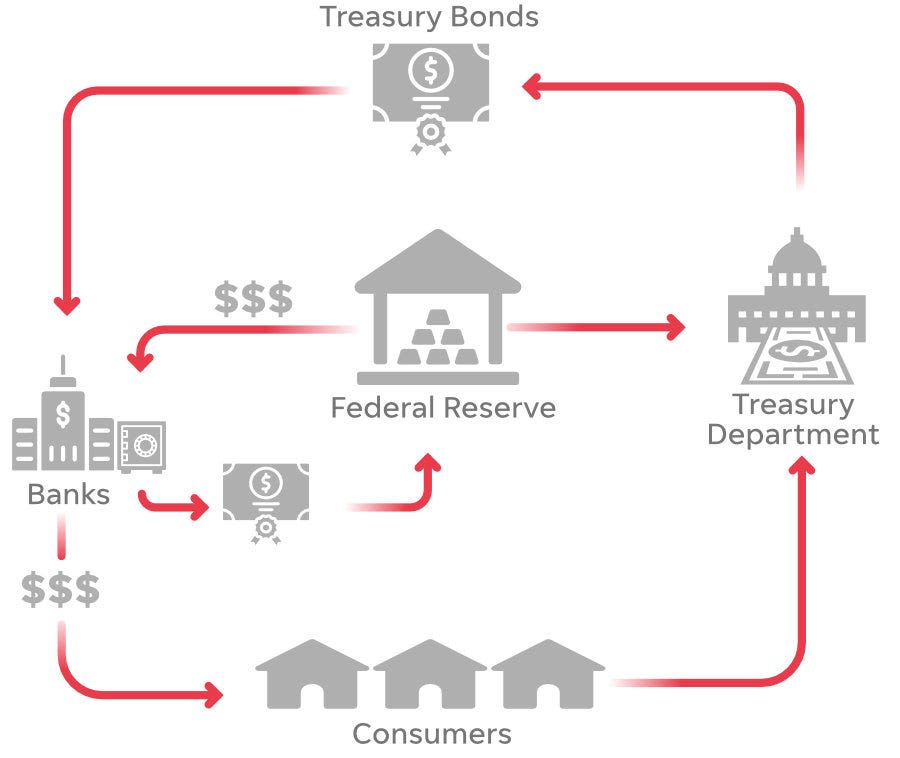

So they then go to their friends, an independent institution called the Federal Reserve Bank (Fed), the only organization permitted to print the coveted '$' US Dollar. The Fed prints money (basically from thin air) and loans it to the government, who in turn uses it for spending.

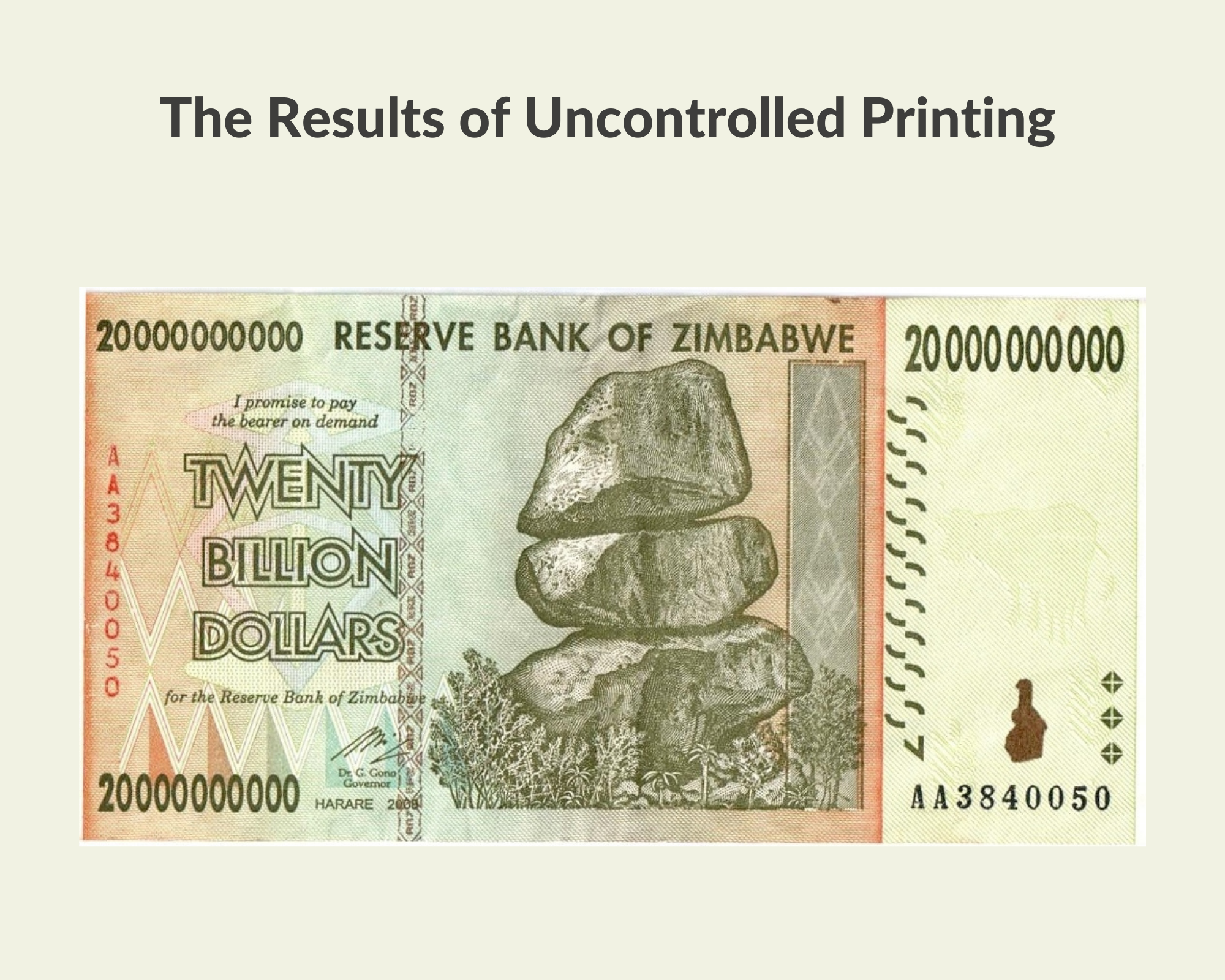

It would still be acceptable if this was the only issue, but what some governments essentially do is that whenever they face an economic crisis they increase the inflow of money into the markets to stimulate it and maintain popularity.

They increase the money supply in a manner that does not match economic growth, and this sudden excess cash is what leads to the Devaluation of Currency.

Why are they allowed to do so?

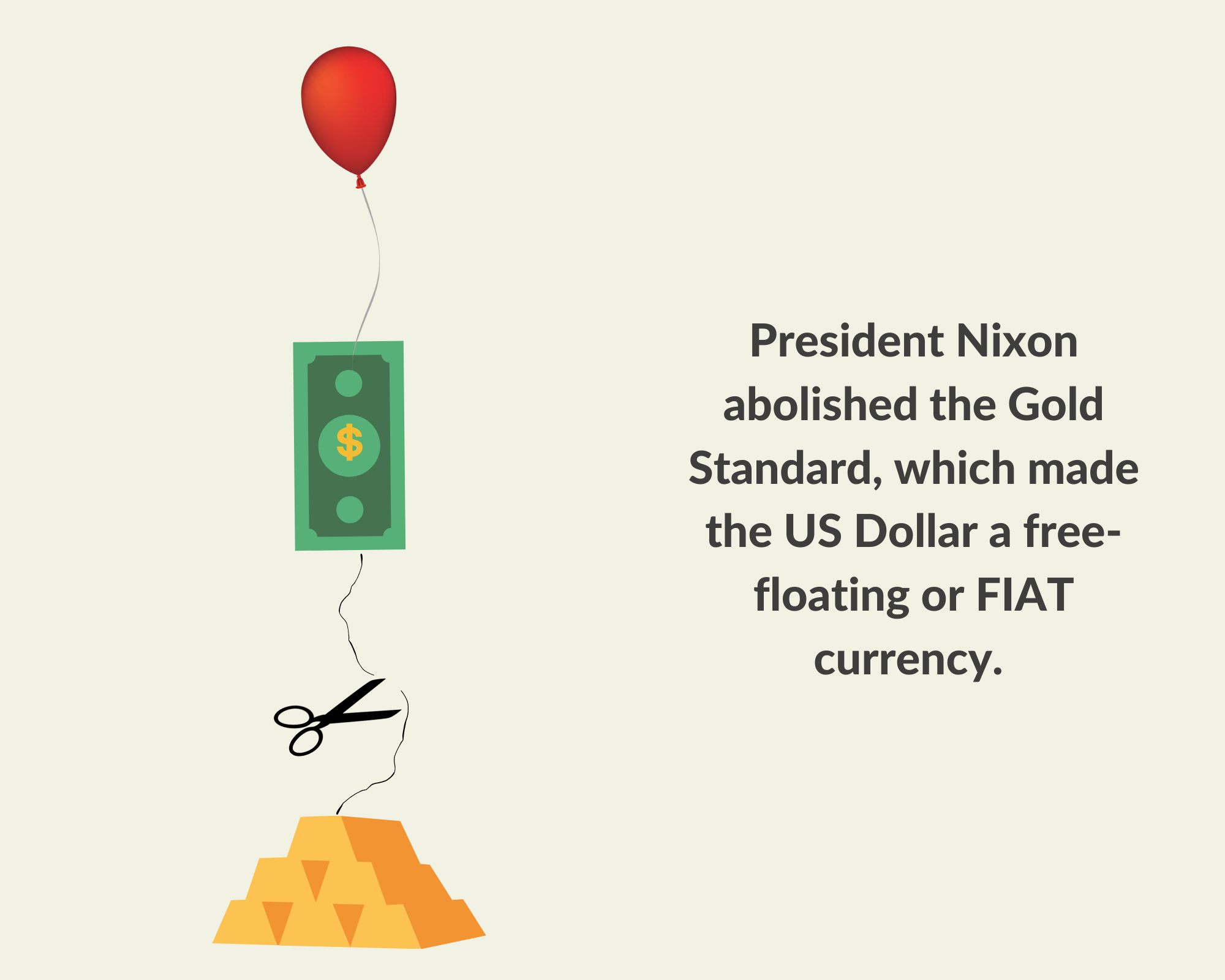

Up until, 1971 the FED could only print money in correspondence with the amount of gold they had in reserve. So each US Dollar was backed to a certain quantity of gold and it was a promise that the possession of a currency note could be traded for that equivalent gold.

In, 1971 President Nixon signed an order that abolished this law, to fight the then ongoing economic crisis by introducing 'controlled inflation'. This essentially made the US Dollar a free-floating currency and gave the FED a license to print.

How Does It affect Your Life?

Lowers Living Standards

The goods you buy are rising in prices, if your income growth doesn't match it then you'll soon have to start compromising on your purchases.

Retirement Plans

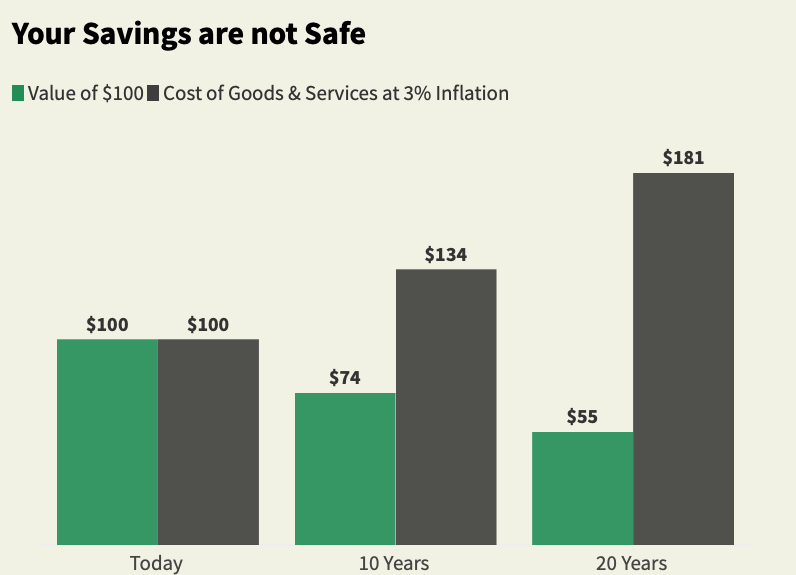

If the rate of inflation pushes higher and your savings account does not match that from its growth rate offerings, your estimated safe fund for retirement will turn out to be less than what was required.

Debt

As inflation rates increase so does the borrowing rate at banks. It becomes more difficult to take a loan and if you have an existing loan with variable interest, inflation will increase your monthly payment amount.

Real Estate

If you are in the market to buy a house, you'll notice that those prices will shoot up with inflation and become less affordable.

Why Should I Care NOW?

As explained in the Money Supply section, every time there's more money in the market than the economic output, inflation occurs.

Now, imagine, what follows when almost 1 in every 5 US Dollars was printed in a single year. That is an absurdly huge amount of money considering the fact that the GDP did not match this growth in any context. The FED says that the ongoing inflation is transitory and will ease out eventually but all the indicators and news say otherwise.

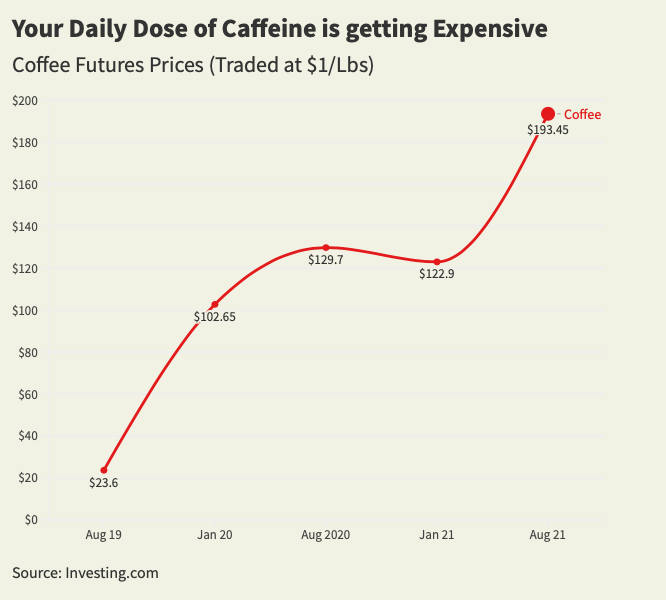

Prices of commodities like coffee and lumber are through the roof, gas prices are off the charts and the real estate market shows no sign of saturation.

It is time to be more aware of inflation as an issue and be active with your monetary decisions rather than passive.

How Can You be Smarter against Inflation?

(Not Investment Advice, Suggestions Only)

Combined with your passive investments and savings accounts, try to Invest in active asset classes such as - growth stocks or dividend paying equities.

If you're in for the long run, consider investing in commodities like gold which have been proven to hold value across centuries.

Exposure to real estate. Owning a property that can generate positive cash flow can generate returns higher than the inflation rate.

Be smart with your purchasing decisions, a few compromises in luxury goods or not-so-essential products can help in redirecting that money to a growing asset.

RESOURCES

The Fed can fight inflation, but it may come at the cost of future growth

Why Does the Fed Care about Inflation?

HOW GOVERNMENT MANIPULATES MONEY AND PRODUCES INFLATION

The Federal Budget in 2019: An Infographic

What Is the Relationship Between Money Supply and GDP?

The Impact of Monetary Policy on Aggregate Demand, Prices, and Real GDP

Inflation and the Money Supply