Eviction Crisis in The United States

Telling Stories With Data

“I’m in limbo, I’m about to get evicted. I’m 61 years old, and I don’t have anywhere to go.” -Ms. Brewer

Millions of Americans like Ms. Brewer are facing displacement due to evictions.

What is an Eviction?

An Eviction occurs when a landloard expels a tenant from a property. This practice is an involuntary move for renters and tends to be initiated when a tenant does not pay rent or is not able to. Other reasons tenants can be evicted can include property damage or violating a lease agreement .

Evictions in the United States

The Covid-19 pandemic has created a housing crisis in the U.S. According to the Aspen Institute, 30 to 40 million Americans are at risk of eviction due to the pandemic.

In 2020, the Center for Disease Control (CDC) implemented a national moratorium on evictions to protect families from losing their homes. However, this protection has expired leaving families unprotected. President Biden's attempt to extend this protection was ruled by the Supreme Court unconstitutional.The Supreme Court's decision makes it challenging to protect families facing eviction notices.

Limited protection for renters and limitations in the distribution of rental assistance by states are contributing to an increasing number of evictions in the U.S.

Eviction Trends

Evictions and eviction filings are an issue that has been present even before the pandemic. Findings suggest that there is an ongoing crisis with evictions and displacement in the rental market. Economic crises seem to increase the number of evictions filings, evictions, and foreclosures. In 2010, during the financial crisis over one million foreclosures were completed nationally.

The graph below shows that national evictions and filing rates have remained constant throughout the years since the 2000s.

By Maryloy on Flickr

By Maryloy on Flickr

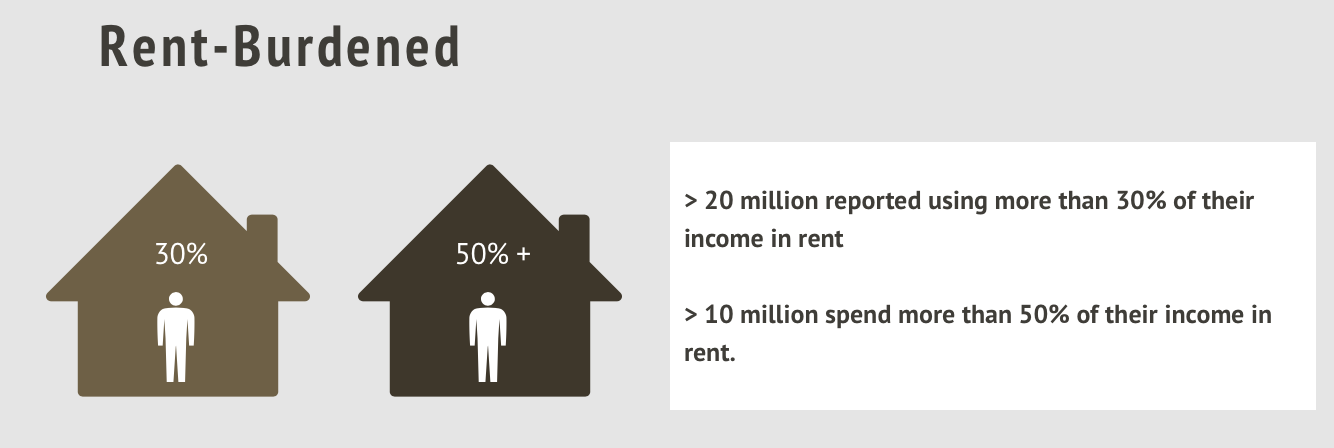

Rent-Burdened Households

Millions of Americans are having difficulty paying rents and mortgages. There is a strong correlation between rent-burdened households and evictions. As the percentage of rent-burdened households increases, eviction, and foreclosures rates increase as well.

The Center for Budget and Policy Priorities found that one in 6 renters nationwide were not caught up on rent.

Additionally, a recent study conducted by the Census Bureau found that in late January 2021, 10 million people were not caught up on rent.

Individuals with full-time positions, still had difficulty with rent payments with over 20 million people spending more than 30% of their income on rent and 10 million spending more than 50% of their income. Multiple households during the pandemic lost their jobs that lead to increases in the accumulation of debt.

Evictions Disproportionally Affect Minority Groups

Evictions impact minority groups disproportionately. Black and Latinx people in the U.S.constitute approximately 80% of people facing evictions.

Job and wage losses due to the pandemic have also disproportionately impacted people of color, further increasing evictions in the country. According to the Aspen Institute, 61% of Hispanic Americans and 44% of Black Americans experienced job losses due to the pandemic, compared to 38% of White Americans.

- People with disabilities tend to face higher rates of unemployment.

- The LGBTQ community tend to experience homelessness at a disproportionately rate.

- Undocumented immigrants do not qualify for unemployment benefits or federal assistance to pay their rent.

The actual numbers of evictions in the country might not be accurate as there are multiple groups of people that have not been included in eviction studies.

By Khoo on Flickr

By Khoo on Flickr

Evictions in Nebraska

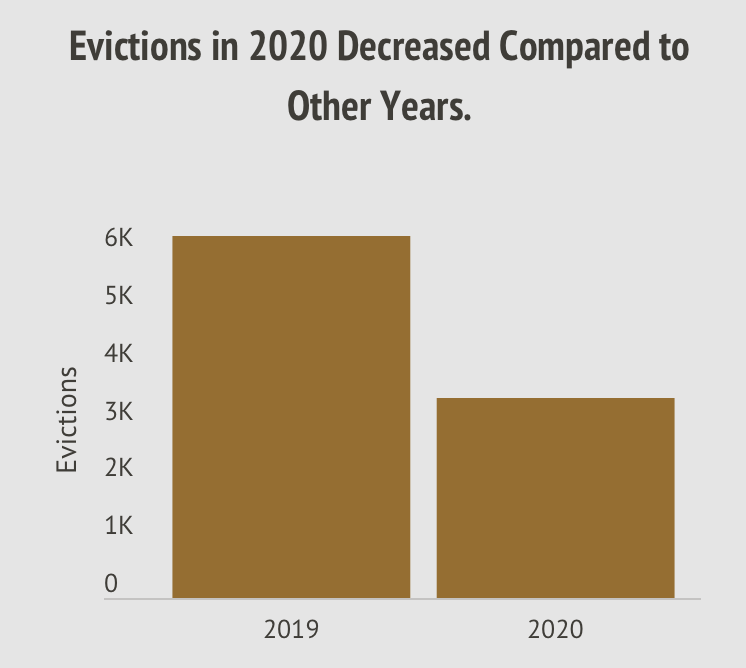

Studies have shown that federal moratoria is effective in reducing the number of evictions.

However, studies show that cities without federal moratoria during the COVID-19 pandemic experienced larger eviction rates. In Nebraska, 55% of evictions occur in Omaha the largest city in the state. Most of the evictions also happen in non-White neighborhoods with more than double the number compared to White neighborhoods. In 2020, 56.7% of eviction cases resulted in eviction compared to years prior to the pandemic.

Data shows that evictions in Nebraska in 2020 decreased compared to other years. On average from 2016 to 2019, more than 6,286 evictions happened in Nebraska. In 2020, the number decreased to 3,482 evictions.

This decrease in is significant as evictions in 2019 decreased from 6,000 to less than 4,000, but this data is not analyzing the changes that took place after the federal moratoria ended. Other factors that might have led to the decrease of evictions could be an increase in legal representations or aid by organizations in Nebraska.

Lack of Legal Representation

People facing evictions tend to face challenges navigating the system and can have difficulties finding representation. In Nebraska, studies have found that of all the defendants on eviction filings only 4.43% had legal representation, while landlords had 100% legal representation. A problem with the lack of legal representation for tenants is that they do not know that they have access to protection and during the pandemic, many did not know they were protected under the CARES Act moratorium. In Nebraska, 40% of filings resulted in an eviction at the time the CARES Act was in place which made it illegal to begin eviction proceedings.

Tenant Assistance Project

Decreases in evictions in Nebraska during the pandemic could be attributed to the increase of legal representation and aid by organizations and universities. The University of Nebraska Lincoln law students created a program called the Tenant Assistance Project that provides legal representation to people facing evictions. During the first federal moratorium, 100 students volunteered to help. The state continues to see low numbers of eviction filings mainly attributed to organizations that decided to help the community. However, these numbers might change with the upcoming reductions of federal assistance. The governor of Nebraska can apply for more funding to help families that are facing eviction and displacement but has decided not to apply.

Nebraska’s governor Pete Ricketts said in a recent interview that

“The federal government has said that you no longer need any impact of COVID to qualify for funding that was specifically allocated to address the impacts of COVID. We should not be using taxpayer money to pay people’s rent without a good reason. It’s irresponsible spending like this that has ushered in record inflation and surging national debt, and in this case, Nebraska has elected not to take part.”

Nebraska and Arkansas are the only two states that haven not applied for the second round of rental relief funds this year.

Impact of Evictions in Communities

Even if eviction filings are low, it is important to help families that have difficulty paying their rent.

Tenants who are displaced are often forced to live in housing in poorer and high-crimeneighborhoods.

Evictions have also been found to cause psychological trauma for children and family members.

Evictions increase health complications and emergency room usage.

Evictions also lead to homelessness.

For physical and emotional wellbeing it is important for states to help people facing evictions and displacement.

CALL TO ACTION

As law students from the University of Nebraska Lincoln have shown, small initiatives can be game changer for communities in need. Another way to help people facing evictions is by contacting representatives to allocate more resources and funding for these communities in need.

More about the Tenant Assistance Program: https://law.unl.edu/civil-clinic-outreach/tenants-rights-project/

More about evictions: Evicted: Poverty and Profit in The American City by Matthew Desmond