All the Work, None of the Stability:

The Gig Economy Experience

America's technology sector has been the focal point of economic growth, replacing traditional American jobs like manufacturing and agriculture. As those sectors began to shrink, so too did wages and employment rates.

The 2008 recession, and the consequent unemployment boom, laid fertile ground for the rise of the gig economy, fueled by this growing tech sector. This new, flexible work environment with a low barrier to entry was thought to be a potential solution to this employment gap.

The value of the gig economy is growing three times faster than other peer industries.

A growing industry means a growing work force.

According to one Gallup poll, over 36 percent of American workers are involved in the gig economy.

That's 56 million people.

Despite the increased value of these companies, this money does not make its way back to workers.

The median income for gig economy workers is $36,500 -- 58 percent that of traditional full-time employees. For workers, particularly in cities where these jobs are more prevalent, this income is a pittance.

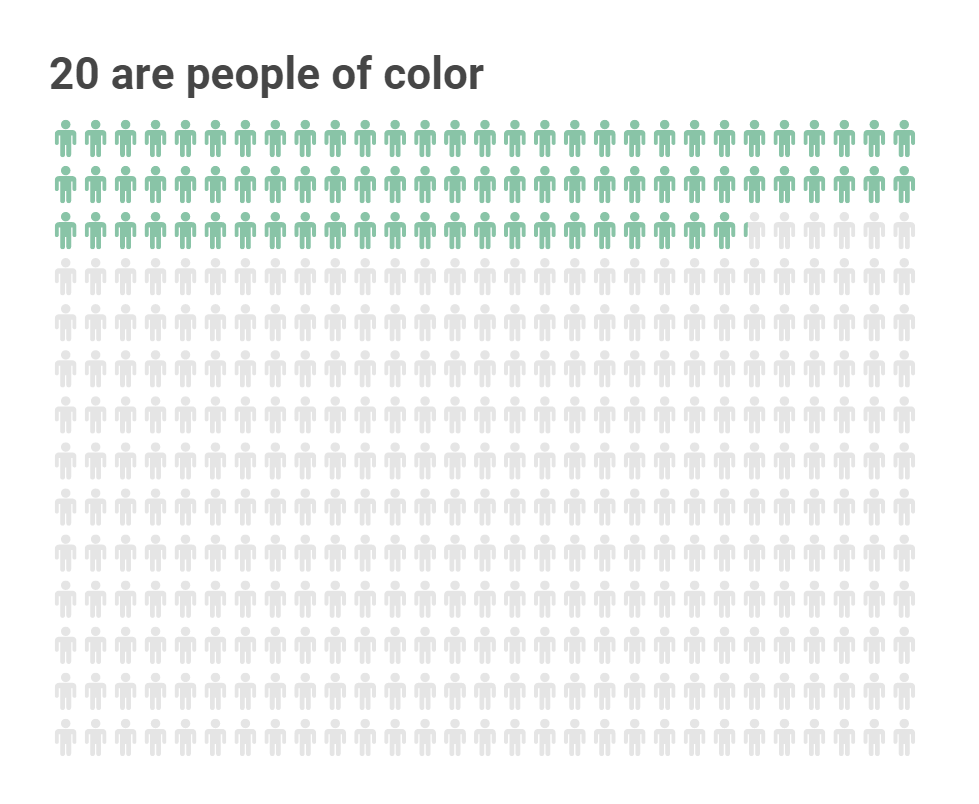

Low incomes mean that the majority of these workers hold multiple jobs.

Though gig economy work was initially thought to serve as a supplemental, part-time job for those who needed the additional flexibility, the reality of the situation is that millions of Americans rely on the "online platform economy" to provide for themselves and their families. By some estimates, 10 to 13 percent of the American workforce, approximately 20 million workers, rely on their gig economy jobs as their primary source of income. Gig economy work, much like other "low-skilled" or minimum wage jobs, is marketed as though their primary goal is to support young people trying to earn some extra spending money. In reality, those performing this type of work rely on these jobs as their primary source of income -- these are people's full-time jobs.

The gross income that makes it to these drivers does not take into account the additional expenses that come with being an "independent contractor." Drivers must cover their own expenses for gas, vehicle maintenance, and insurance; these fees can quickly add up and reduce net income significantly. Some of these drivers make under $800 a month -- which translates to less than $40 per day in net income.

Workers are just one emergency away from bankruptcy.

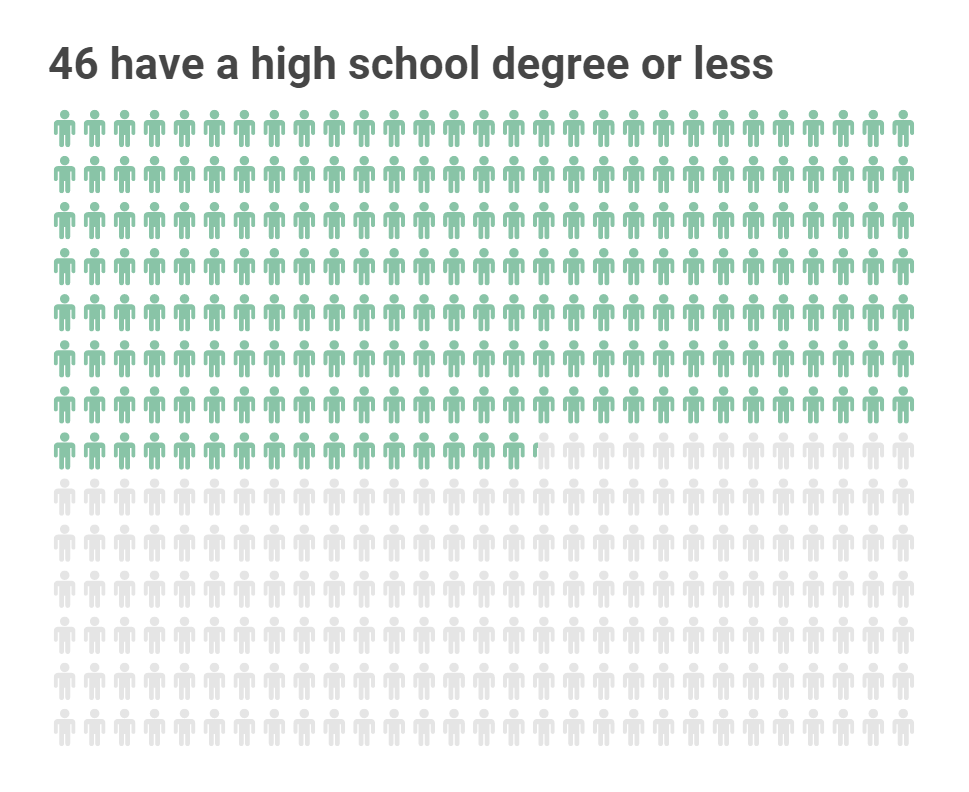

Not an employee? Don't expect any benefits.

Gig economy workers are classified as "contingent" workers and "independent contractors." As they are not considered full-time employees of the companies whose platforms they utilize, those companies are not required to provide these workers with the benefits that full-time employees would receive. These workers are then forced to pay out of pocket for expenses like health, dental, and disability insurance, cutting into their already limited take-home pay.

Failing to classify these workers as employees serves to benefit the companies themselves, who save on tax expenses and the cost of providing benefits. Holding out on these taxes harms out communities too -- one Harvard Business Review report noted that: "New Jersey... alleges that Uber evaded taxes and incurred fines amounting to $650 million by misclassifying their drivers. Similarly, California may have missed out on $413 million in contributions from ridehail companies."

Freelance work and flexibility means instability when something goes wrong.

The pandemic has left more than half of these workers, many of whom are without savings, without an income. While certain services, such as app food delivery, are seeing a boom, high unemployment rates mean that competition for these jobs has become more fierce.

These jobs are particularly vulnerable to any sort of economic downturn, as low wages lead to low savings and accrued wealth.

Without that stability or income, gig workers are unable to invest in their own futures. They are being set up for long-term failure.

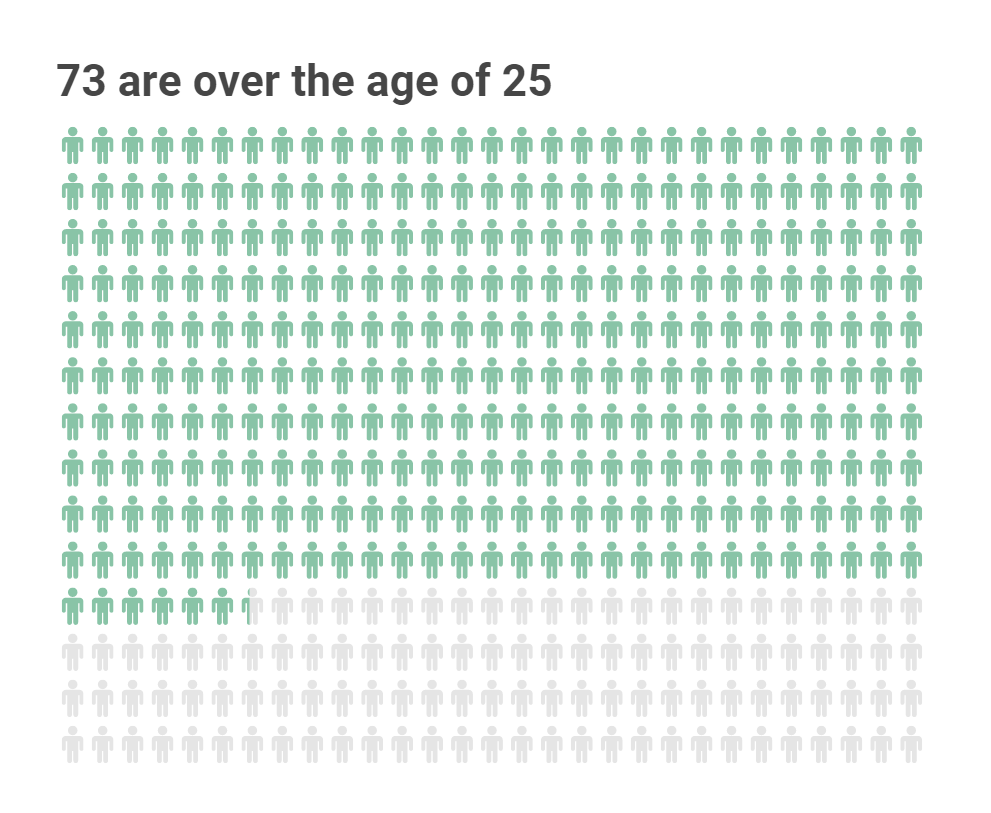

The overwhelming majority of gig economy workers are over the age of 25 -- meaning that they are old enough to start saving for retirement and building up a nest egg to help them survive in their later years.

However, these workers are put in a position such that their income is quickly funneled back into their work and out-of-pocket expenses. Low net income means that it is nearly impossible for gig workers to set money aside for their futures -- coupled with a lack of employer contribution, the retirement funds of full-time gig workers are barren.

What can be done?

Your voice is important.

Contact your representative and ask them to classify gig economy workers as full-time employees in your state.

These workers cannot do it alone. With your help, we have the power to advocate for a more just and equitable work environment.