Infrastructure is deteriorating and bonds aren't helping

This site provides a look into the state of U.S. infrastructure and problems in the municipal bond market. A Heinz College student report will be published in 5/2019, which addresses these problems.

Part I. The Infrastructure Problem

Our roads are cracking, bridges are collapsing, dams are leaking, water pipes are corroding, and public transportation is deteriorating, racking up significant costs in deferred maintenance that must be addressed.

The gap in funds is widening to dangerous levels.

In their Infrastructure Report Card, the American Society of Civil Engineers found that the gap in funds for vital public resources is forecasted to be $2.064 trillion from 2016 to 2025. They anticipate that the most severe gaps will be in surface transportation, schools, electricity, and public parks.

These funding gaps pose a threat to human life.

Source: American Society of Civil Engineers 2017 Infrastructure Report

Drinking Water

With an estimated 6 billion gallons of treated water lost every day due to spillage and water main breaks, investment in water infrastructure is urgent to continue to meet demand over the next 25 years. In particular, aging pipes waste 14% to 18% of treated water, which could support 15 million households.

Public Transportation

With 10.5 billion trips on public transportation in 2015 and demand rising, we must address the $90 billion maintenance backlog. Smoke, fire, derailments, crashes, delays and other events caused by aging infrastructure often make headlines due to the disruptions they cause.

Protection from Natural Disasters

With 15,500 high-hazard dams in the U.S. in 2016, Americans are at risk of losing their lives from flash flooding. For example, there are 139 life-threatening dams in Pennsylvania, 95 in Hawaii, 44 in North Carolina, 40 in New Jersey, and 33 in Texas.

Part II. The Municipal Bond Market Problem

The following section outlines the problems with the current structure of the municipal bond market:

1) generational inequity

2) lack of democratic recourse

3) bank's disinterest in investment

4) lack of savings & poor reinvestment decisions

5) no reporting requirements

6) lack of transparency in general purpose bonds

7) no definition of the “full faith and credit” of a government entity

The following definition of Municipal bonds comes from Wikipedia:

"A municipal bond, commonly known as a Muni Bond, is a bond issued by a local government or territory, or one of their agencies. It is generally used to finance public projects such as roads, schools, airports and seaports, and infrastructure-related repairs."

Problem #1: Generational Inequity

Taxpayers fund assets that they do not use or they freeload off of other generations.

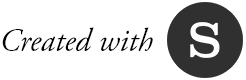

Because the expected useful life of the asset does not have to be evaluated before issuing the bond, the term and useful life does not match. Often, engineers or architects evaluate the useful life at some point in the life of the asset/bond. To further explain the diagram, the bond funds are used to purchase the asset at time 0. It is not until later in the term of the bond that the asset's useful life is assessed.

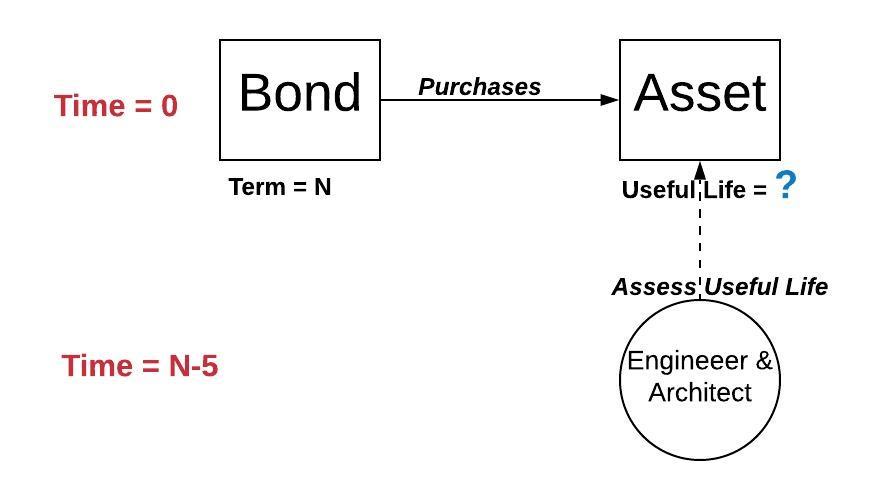

Below you see an illustration of the effect of maintenance on the life of the asset.

Problem #2: Lacks Democratic Recourse

The system violates democratic principles because taxpayers have little recourse when appointed officials issue bonds.

Problem #3: Banks don’t want to invest

Banks leaving the market hurts taxpayers because now government entities have to pay more to borrow money.

Problem #4: Lack of Savings & Poor Reinvestment Decisions

Government entities are not required to save money to pay off the bond, which means investing in public assets is risky, so it costs more taxpayer dollars to borrow money. Also, without requirements around reinvestment of savings, government entities sometimes make risky decisions around taxpayer dollars, which further increases the borrowing costs.

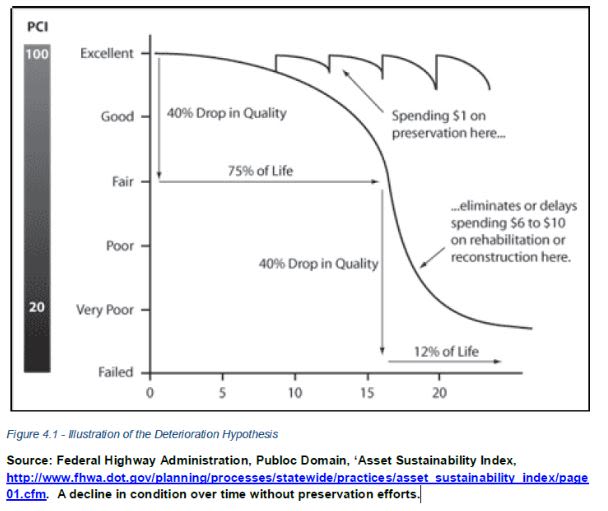

The following graphic shows the level of investment which we see as ideal. It also visualize the process from saving money in the sinking fund to investing it in other securities, which lead to financial gains.

Bond refunding is the process of retiring or redeeming an outstanding bond issue at maturity by using proceeds from a new debt issue. By law, government entities can only do this once per issuance. While sometimes this tool is used because the market interest rate is down, and the entity can use the process to pay a lower coupon payment, sometimes refunding is used to restructure debt service payments because the entity cannot pay their principal back; therefore, needs to issue a bond to help with this. Sinking funds help avoid this practice, yet many government entities do not have them.

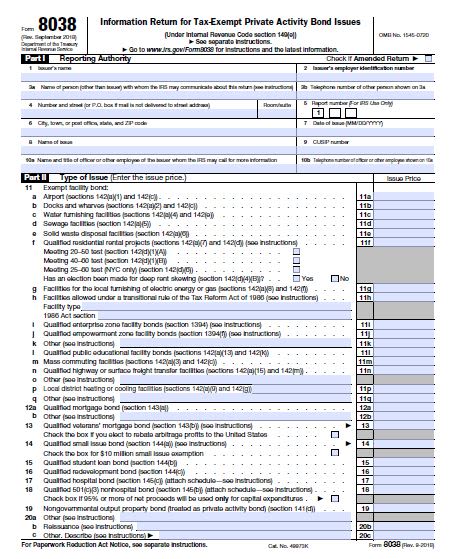

Problem #5: No Reporting Requirements

Government entities do not have regular reporting requirements for the assets funded by previous bond issuances, which leads to a lack of transparency about public goods and lack of accountability for decisions made by officials. Below you will find the current reporting form, which has many flaws that will be highlighted in our report.

Problem #6: Lack of Transparency in General Purpose Bonds

When government entities issue “general purpose” bonds, there is little transparency or accountability for the administered funds, which are paid for by taxpayer dollars.

Problem #7: No Definition of the “Full Faith and Credit” of a Government Entity

The way the law is written, general obligation bonds are backed by the “full faith and credit” of government entities; however, there is no definition of what this means. In the case of default, investors are susceptible to a court's decision on what the government entity must provide to fulfill their contractual obligation of "full faith and credit." Below you will find a graph on the amount of municipal bonds that are issued as revenue bonds versus general obligation bonds. While not inherently bad, there are less disclosure requirements on general obligation bonds - meaning that the general public does not always know what the money is being used for.

Part III. The Solution

Congress must establish a Qualified Municipal Infrastructure Bond (QMIB) program. The IRS would implement and administer this optional bond program, which will qualify bonds as legitimate, thus lowering interest payments by governments, increasing transparency for the general public, and maximizing security for the investors. Bonds with QMIB status will represent only some fraction of the total municipal bond market as government entities will need to opt-in to all requirements and be approved by the IRS to participate.